Examine This Report on Kam Financial & Realty, Inc.

Examine This Report on Kam Financial & Realty, Inc.

Blog Article

About Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. Things To Know Before You Get ThisSome Known Factual Statements About Kam Financial & Realty, Inc. The Of Kam Financial & Realty, Inc.The Main Principles Of Kam Financial & Realty, Inc. Kam Financial & Realty, Inc. for BeginnersKam Financial & Realty, Inc. Can Be Fun For Anyone

A home loan is a loan used to purchase or keep a home, story of land, or other genuine estate. The debtor accepts pay the loan provider with time, typically in a collection of routine settlements separated into principal and passion. The building after that acts as collateral to secure the loan.Mortgage applications go through a strenuous underwriting procedure before they get to the closing stage. Home mortgage kinds, such as conventional or fixed-rate loans, differ based upon the debtor's requirements. Home mortgages are finances that are made use of to get homes and various other kinds of realty. The residential property itself works as security for the financing.

The expense of a mortgage will certainly depend on the type of car loan, the term (such as 30 years), and the rate of interest that the loan provider charges. Mortgage prices can vary commonly depending on the sort of item and the certifications of the applicant. Zoe Hansen/ Investopedia People and organizations make use of mortgages to get property without paying the entire purchase rate upfront.

Not known Facts About Kam Financial & Realty, Inc.

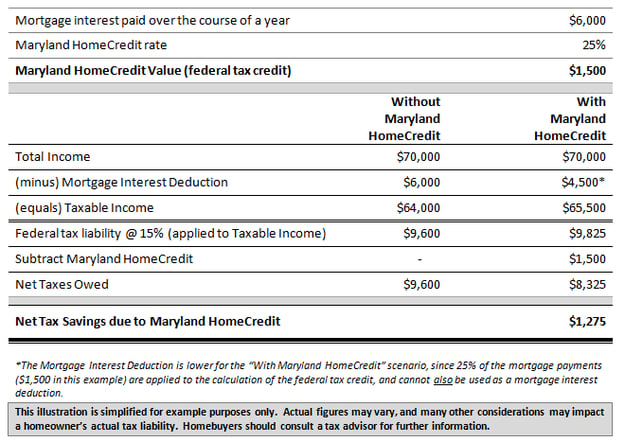

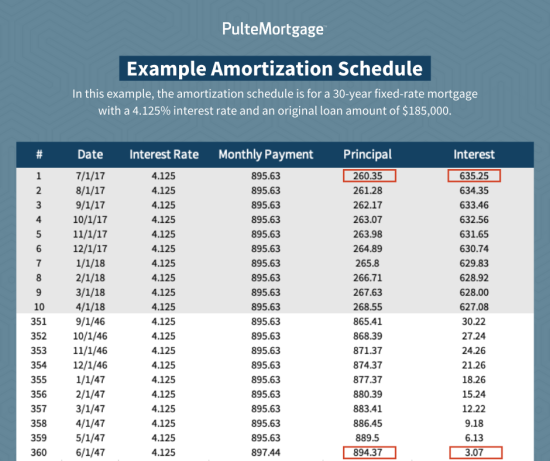

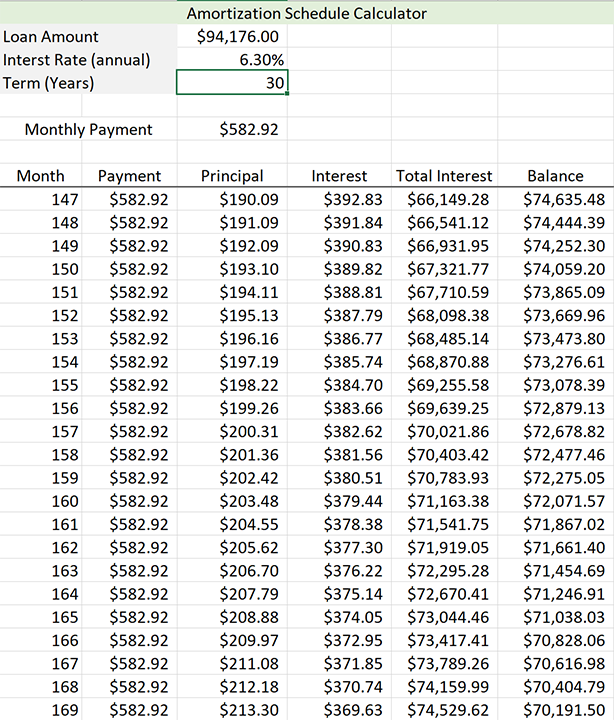

The majority of typical home mortgages are totally amortized. This indicates that the normal payment amount will stay the exact same, yet different proportions of principal vs. passion will be paid over the life of the loan with each payment. Common home loan terms are for 15 or 30 years. Home mortgages are likewise referred to as liens versus building or insurance claims on home.

A residential buyer promises their home to their loan provider, which then has a claim on the property. In the case of foreclosure, the lender may evict the residents, sell the residential or commercial property, and use the cash from the sale to pay off the home mortgage debt.

The lending institution will ask for evidence that the consumer is qualified of repaying the finance. https://dc-washington.cataloxy.us/firms/www.ghwickser.com.htm., and evidence of present work. If the application is authorized, the lending institution will certainly provide the consumer a financing of up to a specific amount and at a certain interest rate.

Kam Financial & Realty, Inc. Fundamentals Explained

Being pre-approved for a home mortgage can provide purchasers an edge in a tight real estate market since vendors will certainly understand that they have the cash to back up their deal. When a buyer and seller concur on the regards to their offer, they or their reps will fulfill at what's called a closing.

The vendor will certainly transfer ownership of the residential property to the customer and receive the agreed-upon sum of money, and the purchaser will certainly authorize any staying home mortgage files. The loan provider might bill costs for coming from the funding (sometimes in the type of points) at the closing. There are numerous options on where you can obtain a mortgage.

Getting The Kam Financial & Realty, Inc. To Work

The common kind of home mortgage is fixed-rate. A fixed-rate home mortgage is additionally called a conventional home mortgage.

The 20-Second Trick For Kam Financial & Realty, Inc.

The whole car loan balance comes to be due when the consumer passes away, moves away permanently, or offers the home. Within each type of home loan, consumers have the option to purchase discount factors to purchase their rate of interest down. Points are essentially a cost that debtors pay up front to have a lower rate of interest over the life of their financing.

What Does Kam Financial & Realty, Inc. Do?

Just how much you'll need to pay for a home loan depends on the kind (such as dealt with or flexible), its term (such as 20 or thirty years), any type of discount points paid, and the passion prices at the time. mortgage lenders in california. Rate of interest can vary from week to week and from loan provider to lending institution, so it pays to search

If you default and confiscate on your mortgage, nonetheless, the financial institution might end up being the brand-new proprietor of your home. The price of a this website home is typically much greater than the quantity of cash that most households save. Because of this, home loans permit individuals and households to purchase a home by taking down just a reasonably tiny down repayment, such as 20% of the purchase rate, and obtaining a car loan for the balance.

Report this page